Booking Holdings: Leisure Travel At Risk (NASDAQ:BKNG)

5 min readajr_illustrations or photos/iStock by using Getty Visuals

Financial investment thesis

Reserving Holdings’ (NASDAQ:BKNG) final results for Q1 FY12/2022 highlighted good administration commentary about gross bookings in April 2022 reaching pre-pandemic degrees. Despite these kinds of optimistic details, the shares have reacted tiny. We imagine the price of dwelling crisis will hit vacation behavior negatively into H2 FY12/2022, slowing the rate and scale of recovery. With consensus estimates seeking much too bullish, we level the shares as neutral.

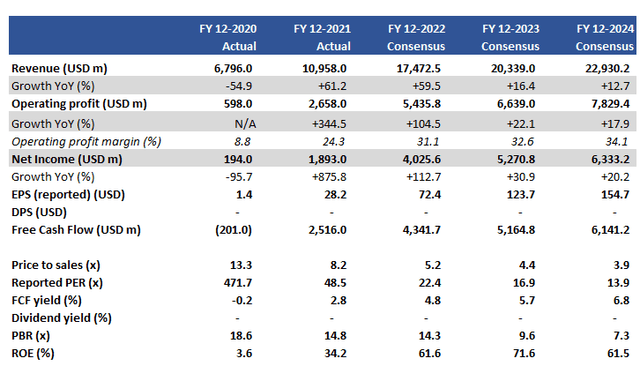

Essential financials and consensus earnings estimates

Vital financials and consensus earnings estimates (Firm, Refinitiv)

Our targets

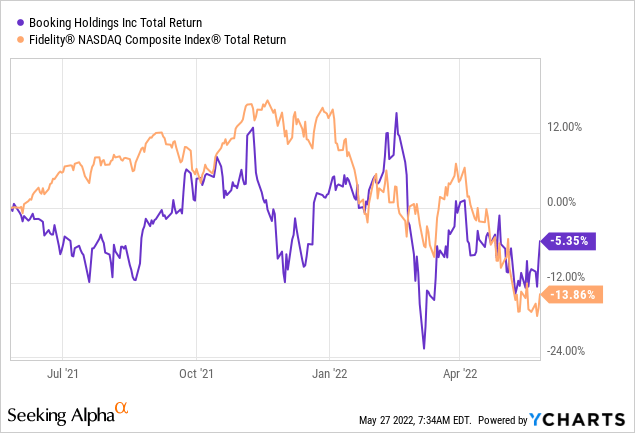

The loosening of journey limits publish COVID19 should herald a period of time of solid demand for Scheduling Holdings, coming in the type of pent-up demand from both business and leisure tourists. Booking’s shares have outperformed the NASDAQ Index in the last 12 months but not by a extremely substantial margin.

In this piece we want to evaluate the pursuing:

- Evaluate the level of existing need for journey, and its outlook offered the softer outlook in buyer sentiment.

- Revisit our offer advice from March 2021, using into account consensus estimates for the next two yrs.

We will take every a person in switch.

Demand from customers remains smooth

The summary we come to is that sad to say for the journey sector, need at this time stays softer than hoped. With quite a few components of the entire world going through a expense of living disaster, and the Russian invasion of Ukraine ensuing in a key boost in the value of fundamental items, we think this will have a significant detrimental effects on the foreseeable future restoration of leisure travel.

We obtain knowledge disclosed by the UNWTO (United Nations Planet Tourism Group) as 1 indication of the tourism industry’s overall health. Even though the data obtainable is not absolutely up to date, their Tourism Recovery Tracker emphasize good data YoY in the recovery in vacation sentiment and quick-expression rental need for April 2022. However, what continues to be deeply negative YTD vary from genuine air reservations down 70% YoY, resort bookings down 69%, and reduced hotel occupancy fees at 58%. There is proof of restoration in other places, for occasion, Japan has witnessed a 1,185% YoY increase in abroad vacationers in April 2022 but this stays down 95% from the amounts viewed in pre-pandemic April 2019. The hurdle prices versus pre-COVID19 ranges are extremely higher.

The threat from climbing charges will effects prospects as very well as the hospitality trade by itself, which is also experiencing growing input fees in power, foodstuff and wine, and payroll. A opportunity drop in supply will also be a negative for travel web-sites as service provider volumes start out to drop off.

Business vacation seems to be faring far better. American Categorical World-wide Business Vacation (which is merging with SPAC Apollo Strategic Progress Funds (APSG)) commented that the 1st three weeks of April 2022 saw transactions access 72% of 2019 stages. There appears to be much better momentum listed here vs . leisure with the corporate earth returning to travel. The problem below would be that with business vacation creating up close to 20% of the total sector, the field can only be truly saved with leisure volumes returning.

The consensus seems to be much too bullish (once again)

In our prior remark in March 2021, we felt that consensus forecasts were far too bullish, significantly for business journey recovery and we rated the shares as a provide. This time, we believe consensus is once once again currently being as well bullish for the next explanations.

For FY12/2022, we consider the ‘bumper’ summer time of demand from customers is not likely to be sustainable. In the final results simply call for Q1 FY12/2022, management commented that at Booking.com gross bookings for the summer time period of time had been around 15% bigger than at the identical place in 2019 – but a substantial percentage of these bookings were being cancelable and the booking window had recovered (folks reserving in advance were similar to pre-pandemic amounts, therefore have sufficient time to cancel). The key difficulty is about how sustainable this desire profile is versus a one-time restoration from pent-up need. With the recent macro surroundings, we are unable to envisage a regular recovery that spills about into H2 FY12/2022.

What also looks too bullish is consensus estimating that the company’s annual revenues will preserve recording double-digit development into FY12/2023 (+16.4% YoY) and FY12/2024 (+12.7% YoY). In the heady times of progress concerning FY2015-2019, the business grew income by 13.% YoY CAGR – we locate it quite tough to consider that it can match this kind of advancement fees taking into consideration inflationary price pressures, slipping requirements of dwelling, and larger hurdles YoY.

The two recent spots of weak spot for the business are the Asia market and extended-haul worldwide vacation. With journey limits getting to be lifted, there will be a surge in need but the problem will be the level of recovery in ADR (regular everyday rates) in lodging which will acquire some time. Also, in the world of distant do the job, the have to have for business travel has fallen which will have a long lasting affect on global vacation volume.

Booking Holdings could goal to boost marketplace share to speed up topline advancement, but we think the overall marketplace pie requires to increase for the corporation to carry out for each consensus estimates. This does not appear possible to us at this position.

Valuations

On consensus estimates (in the desk previously mentioned in the Key Financials portion) the shares are investing on a free funds stream yield of 5.7% for FY12/2023. This is an desirable produce and would place the shares in the undervalued category. Having said that, with consensus estimates showing up way too bullish we believe a more sensible produce to be all over 4%. Therefore, the shares glance more relatively valued.

Dangers

Upside danger will come from a sustained need recovery in leisure journey as restrictions are lifted and people start out to allocate spending on holidays. The enterprise has witnessed powerful figures in April 2022, and if such traits go on the outlook is optimistic.

A rather swift conclusion to the Russian invasion of Ukraine will guide in lifting buyer sentiment as effectively as positioning some downward tension on inflation (especially for agricultural food items charges).

Downside risk arrives from the boost in the charge of residing which qualified prospects to vacationers ‘trading down’. The selection of lodging concentrates on reduced priced stock ensuing in slipping ADR and revenues.

A protracted conflict in Europe threats acquiring other sovereign countries receiving included, which would place stress on the European travel market place. The cancellation charge may possibly improve as a consequence.

Summary

Irrespective of encouraging comments from administration about latest trading, the firm’s shares have reacted tiny. We place this down to the marketplace evaluating the threat of a international recession and the unfavorable impression this will have on holiday break habits. Even though we expect a restoration for the business, we think the rate and scale will be slower and smaller sized than recent consensus estimates. With sector anticipations remaining reasonably superior, we now rate the shares as neutral.